Introduction

The client is a regulatory compliance firm that aims to simplify the process of filing company information with the Financial Crimes Enforcement Network (FinCEN). They aim to build a user-friendly SaaS platform that enables users to enter, update, and manage their company information efficiently while ensuring compliance with FinCEN regulations. Users have the option to update or resubmit previously submitted files, as well as submit new files for the first time. Multi-submission and bulk upload through CSV.

Application Details

The project is structured with several milestones strategically placed to ensure timely completion and efficient management. Each milestone is focused on achieving precise objectives and deliverables, enabling systematic monitoring of progress and ensuring successful completion of crucial stages throughout the development phase.

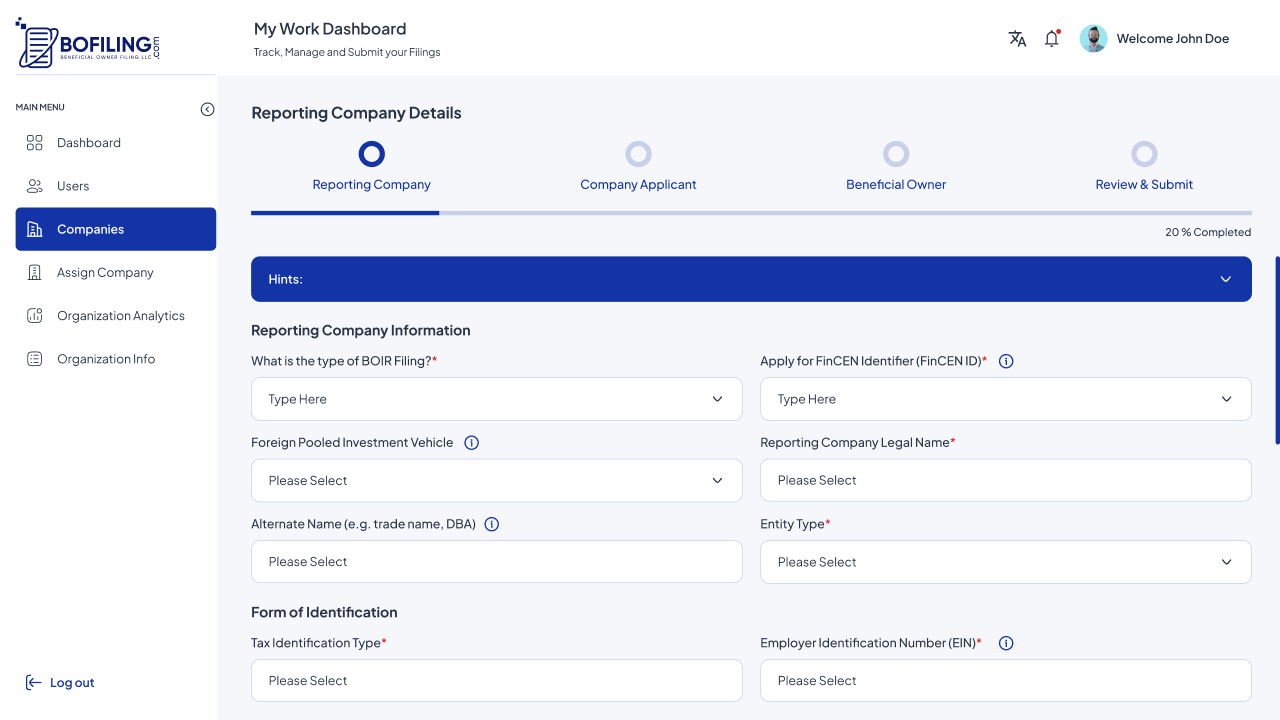

1. Platform Development

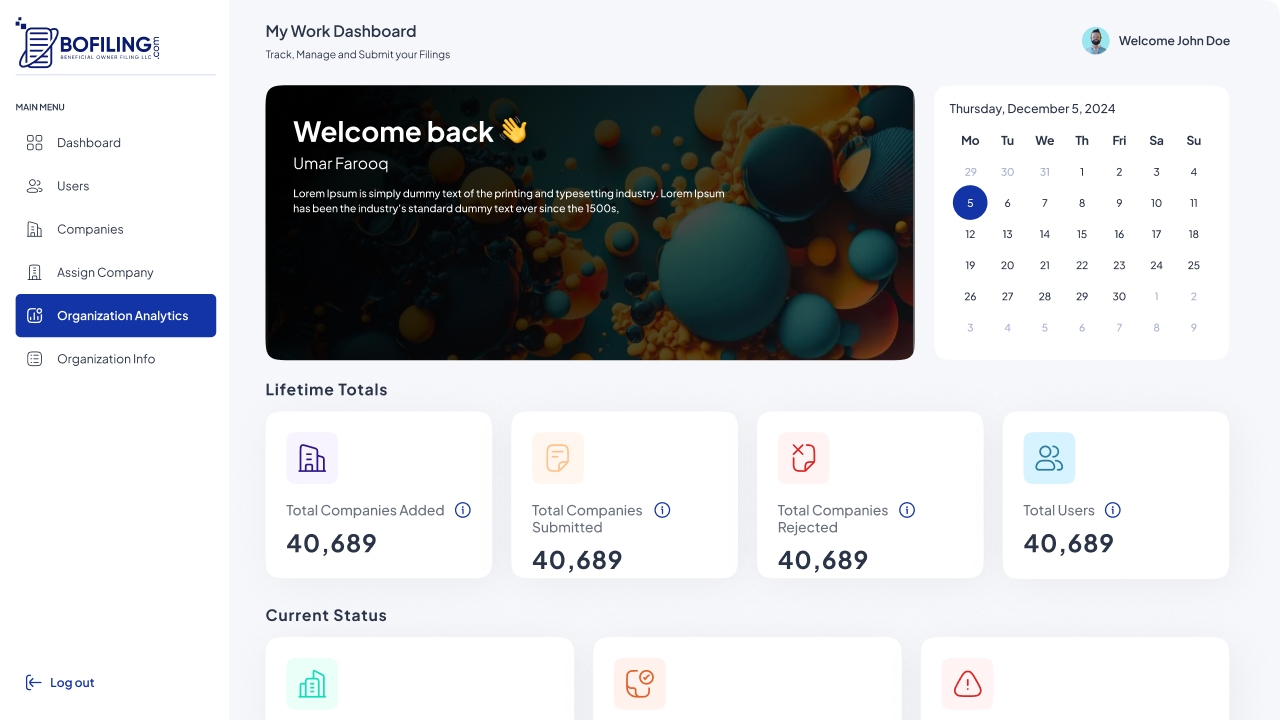

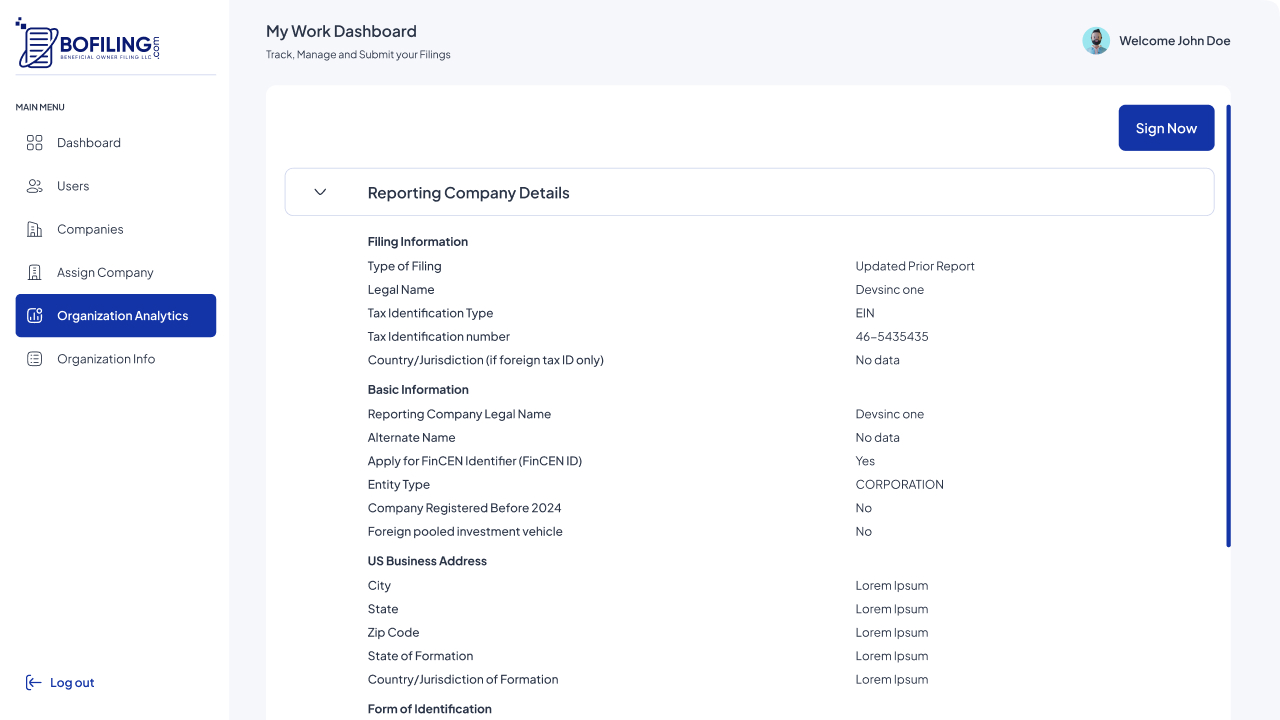

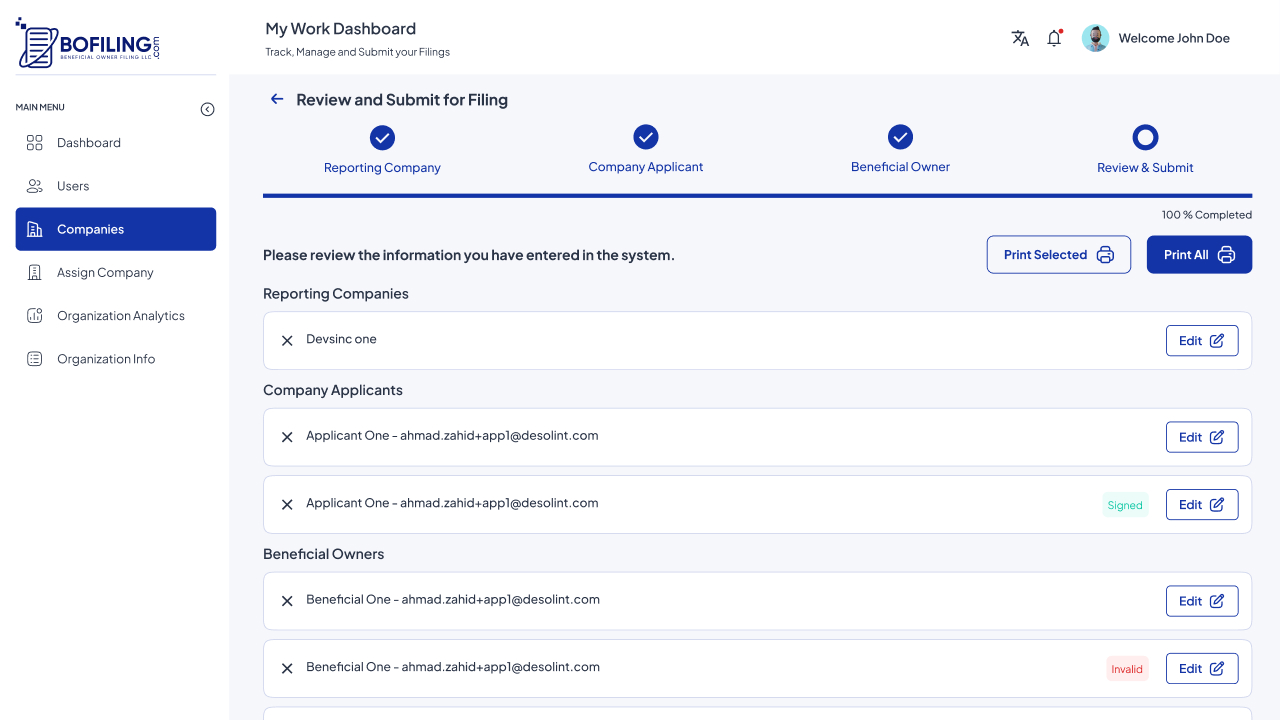

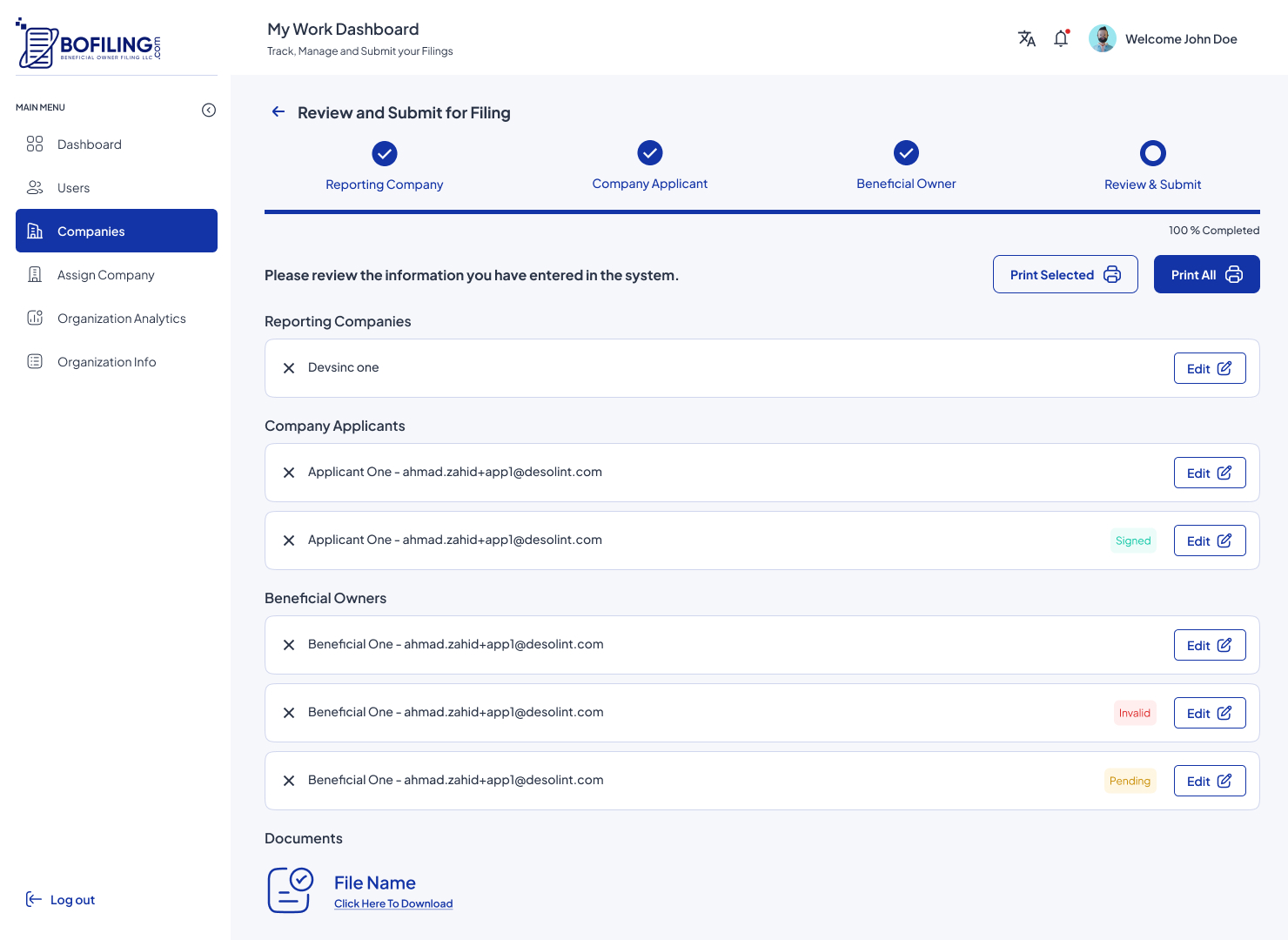

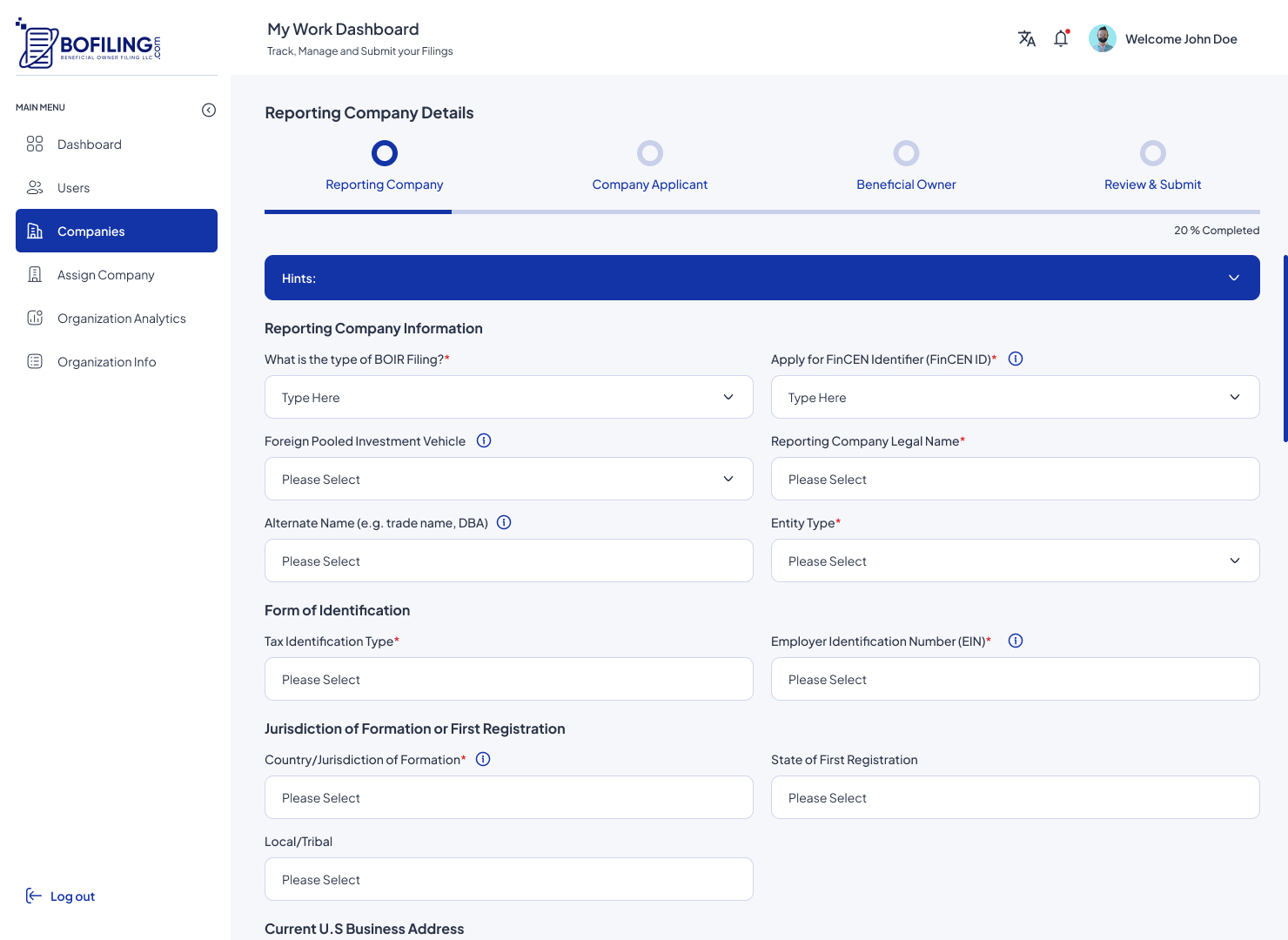

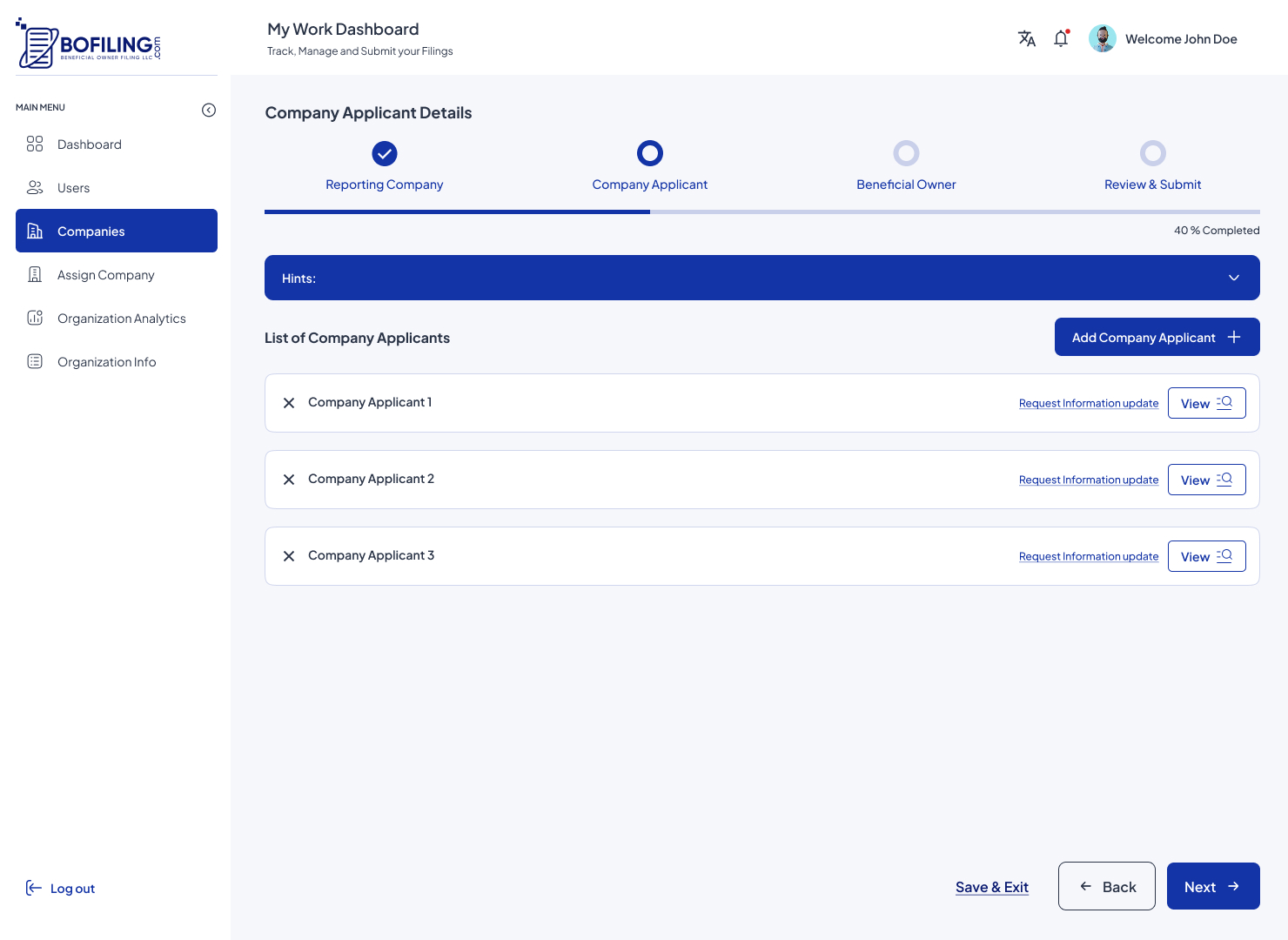

The platform features a user dashboard as a centralized hub where users can view and manage their company information. This includes tracking submission progress and handling updates and signature requests. Data entry forms are designed to be intuitive, capturing all necessary company details for FinCEN compliance, with built-in validation checks to ensure data accuracy. The submission module allows for a seamless process of submitting company information to FINCEN, with confirmation and tracking features providing users visibility.

2. Information Management

Users can update or edit their submitted information at any time, with options to save changes for future use. Participants (Company Applicants and Beneficial Owners) can log in to their personalized dashboards to modify their personal information and update it as necessary. This ensures that all data remains current and accurate, with changes logged for auditing purposes. The platform maintains a detailed history of every update, enabling transparency and traceability.

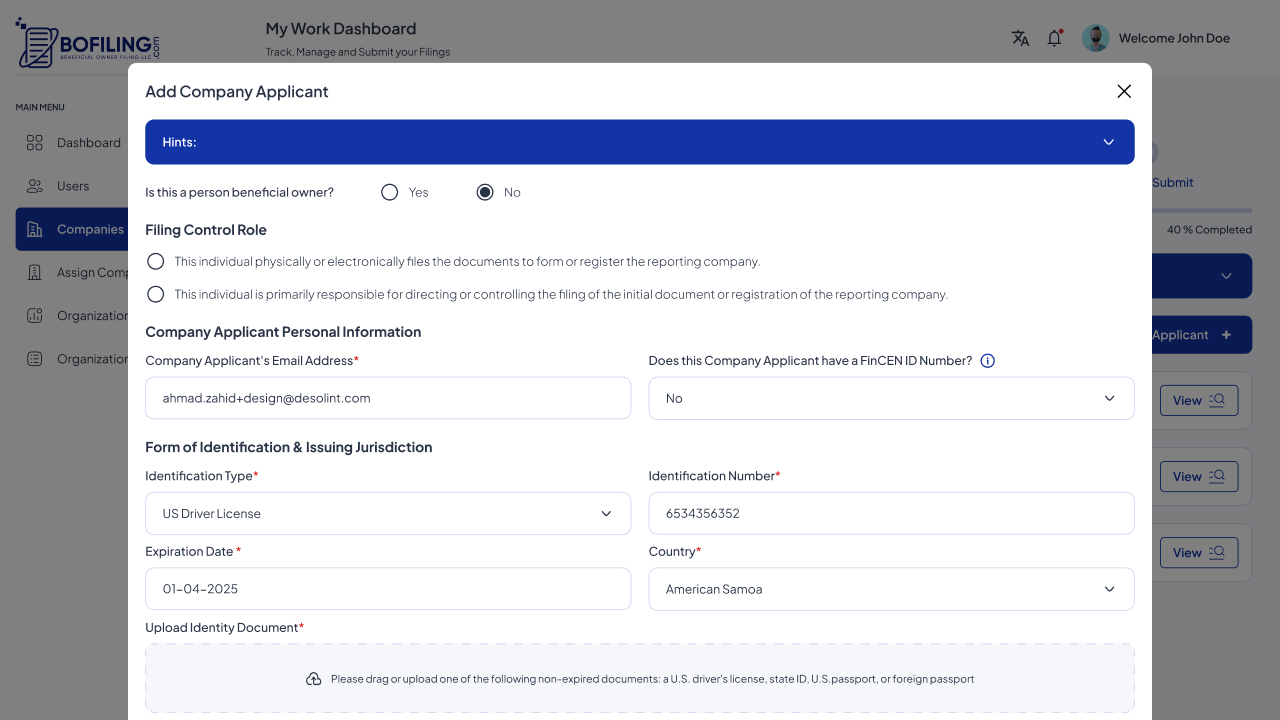

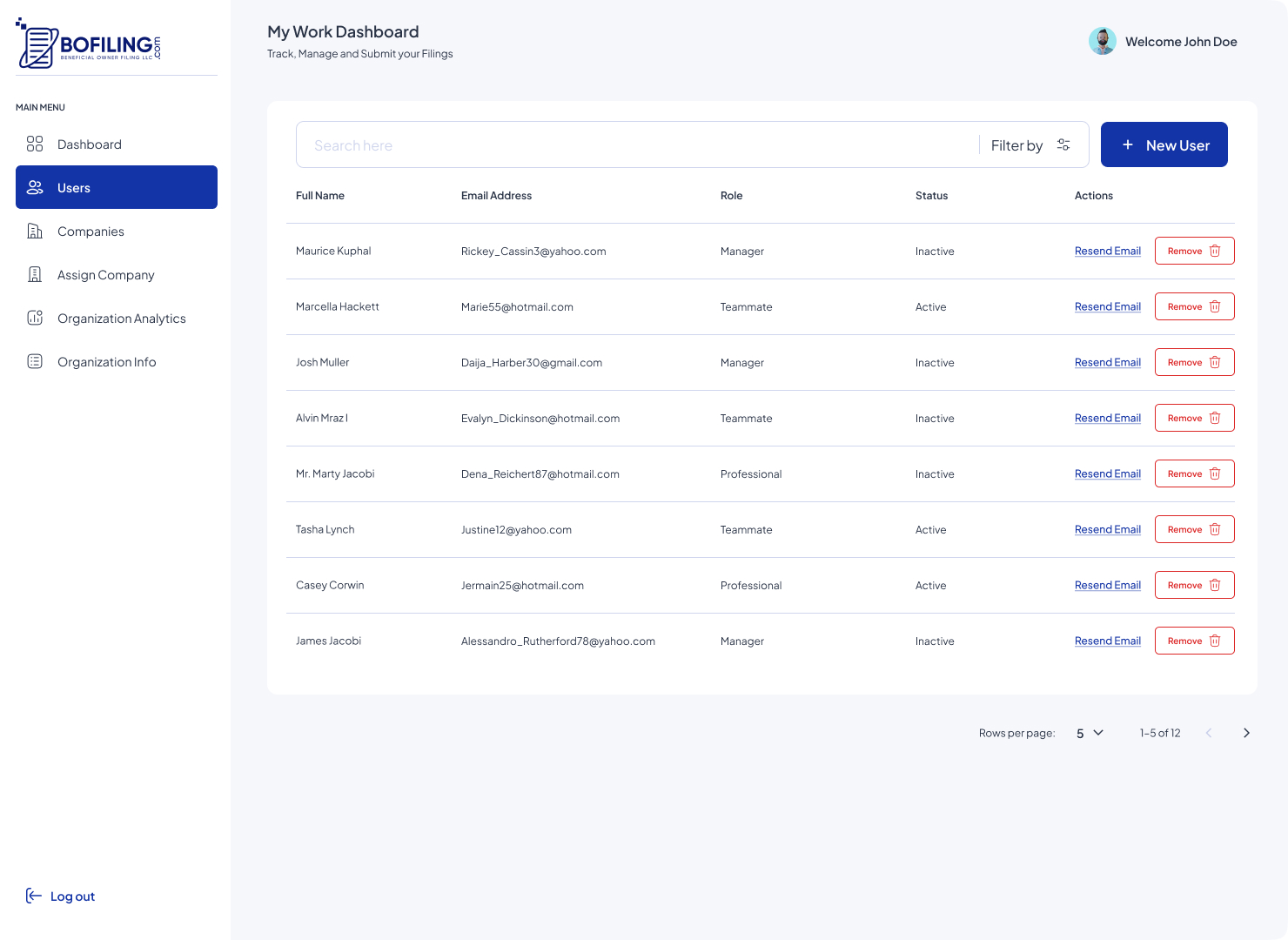

3. Collaboration Tools

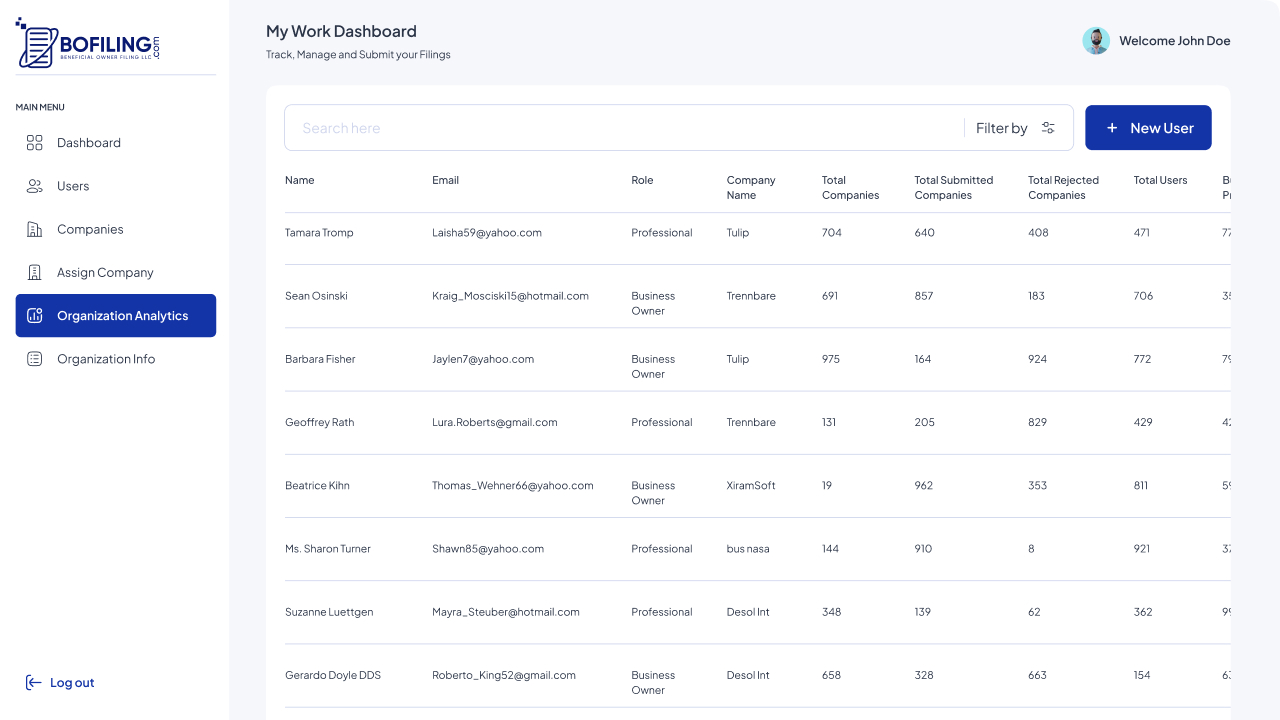

The platform supports collaboration through user invitations, allowing users to invite other participants (Company Applicants and Beneficial Owners) to contribute information, fostering a collaborative environment. Role-based access control is in place to ensure that different roles and permissions manage who can view, edit, or submit company information, enhancing overall security. Role-based authentication and authorization ensure that only authorized users (Professionals, Managers, Teammates, and Assistants) can perform specific actions.

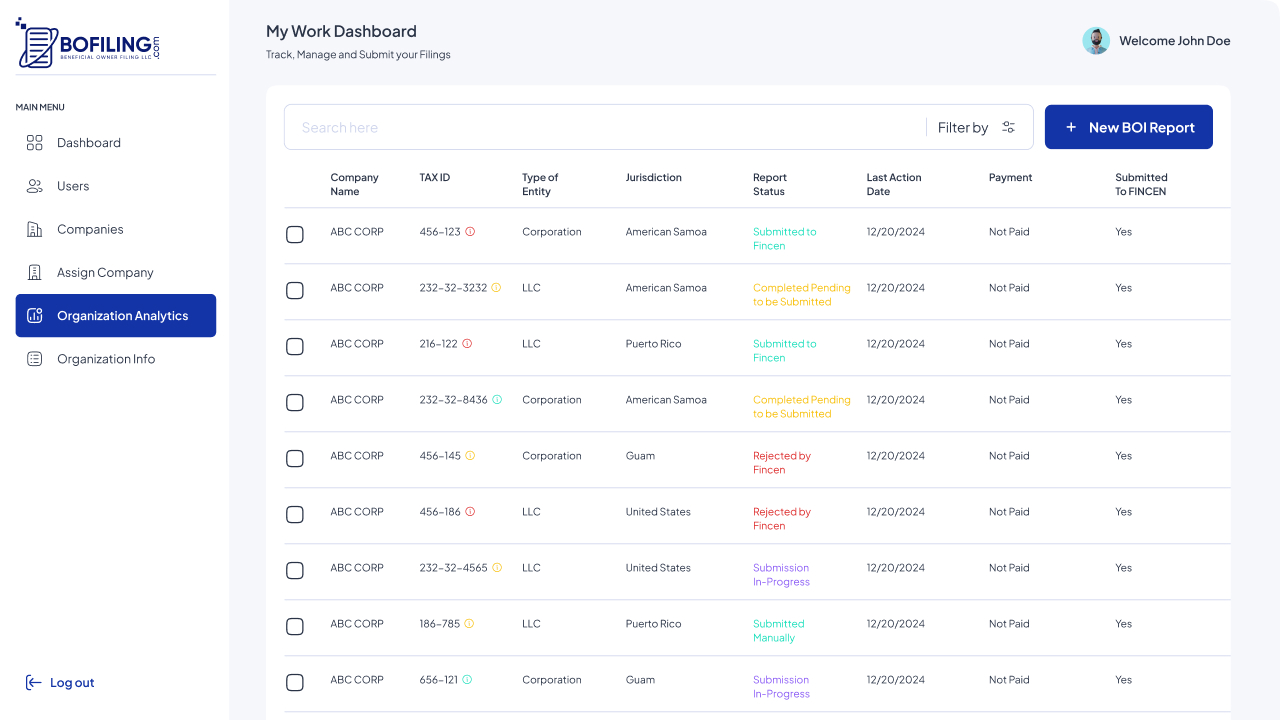

4. Multi-Company Management

The company module enables users to manage multiple companies under a single account. Users can easily track submission statuses and handle tasks for each company. Also provides comprehensive PDF reports for all company details, enhancing documentation and record-keeping after the company detail is completed. The assignment features enable existing participants (Company applicants and Beneficial Owners) to link with companies and share responsibility, while the bulk upload via CSV feature allows multiple companies’ information to be uploaded to the platform simultaneously and then the user can submit the uploaded companies to FinCen. This feature handles various scenarios, formats, and validations, ensuring resource efficiency.

5. Signature Request Feature

Users can select specific companies for participant signatures, ensuring that information is reviewed and approved. Participants have access to a dedicated dashboard where they can log in to review and verify company information before signing. The digital signature process includes approval, locking, and notification functionalities. The verification process ensures data accuracy and compliance, with an audit trail of all signature requests maintained for traceability.

6. Additional Features

- Custom Soft Delete: Implemented to allow users to remove data without permanent deletion, enabling recovery if needed.

- Custom Rollback: This feature ensures data integrity during long-running CSV uploads, with a con job as a backup to handle drafted collections if needed.

- Socket Communication: Utilized for backend processes to handle real-time actions and updates.

- PDF Generation: Provides comprehensive PDF reports for all company details, enhancing documentation and record-keeping.

- Email Notifications: The platform handles email invitations and notifications, ensuring that participants and agency users are informed of updates related to their linked companies.

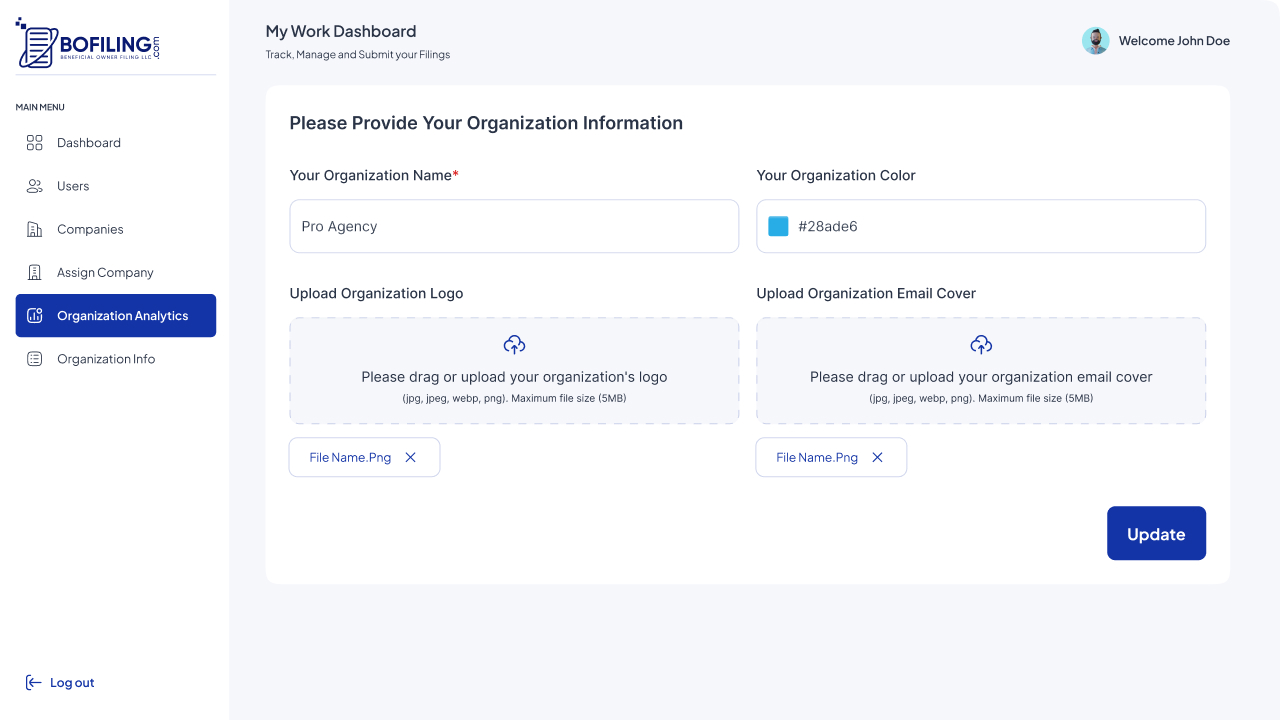

- White Labeling: Allows customization of the platform’s appearance to match the client’s branding.

- Analytics: This feature offers insights and analytics for main users, such as admins, professionals, and business owners, to monitor platform usage and performance.

- FinCEN Integration: Managed in multiple steps, including data uploads, error handling, and user-friendly transcript generation for any issues encountered. The company is locked during this process to maintain data integrity.

Technical Implementations

Backend: Node.js, Express

Node.js and Express were chosen for the backend to provide a scalable and efficient server environment. Node.js’s non-blocking, event-driven architecture allowed the platform to handle multiple concurrent submissions and user interactions smoothly. Express, a minimal and flexible Node.js web application framework, facilitated the rapid development of robust APIs to manage data flow between the frontend and the database.

Frontend: Next.js

Next.js was selected for the frontend due to its server-side rendering capabilities, which enhance performance and SEO. It’s hybrid static and server rendering allowed for fast page loads and seamless user experiences. The use of React components within Next.js ensured a modular and maintainable codebase, enabling quick feature iterations and UI enhancements.

Database: MongoDB

MongoDB, a NoSQL database, was utilized for its flexibility in handling unstructured data and its scalability to accommodate growing datasets. Its schema-less nature allowed for easy adjustments to data models as project requirements evolved. MongoDB’s support for distributed systems ensured the high availability and reliability of the data.

Implementation Challenges

1. Multi-Submission Handling

Ensuring that a company is eligible for submission involved implementing checks to lock the company data during the submission process to prevent concurrent updates. This was managed using queues and worker threads to handle simultaneous submissions efficiently, maintaining data integrity and avoiding conflicts.

2. Signature Management

The system needed to handle the invalidation of participant (Company Applicants and Beneficial Owners) signatures when company or participant details were updated. This applied both within a specific company and across all companies where the participant had roles. Ensuring that all signatures remained valid and reflective of the most current information was crucial for maintaining compliance and trust.

3. Role-Based Access Control

Managing multiple roles with different access levels required a robust role-based access control system. This allowed for precise control over who could view, edit, or submit information, ensuring that sensitive data was only accessible to authorized personnel.

4. CSV Uploads

The platform supported the addition of companies through CSV file uploads. This feature included extensive validation processes to ensure data accuracy. During the upload process, participants(Company Applicants and Beneficial Owners) were also created and associated with the relevant companies, streamlining the onboarding process for large datasets. A Custom rollback was also implemented to handle the process of long-running CSV upload.

Conclusion

The SaaS platform provided a comprehensive solution for filing company information with FINCEN, streamlining processes, ensuring compliance, and enhancing user satisfaction. Custom features like soft delete, rollback, real-time communication, PDF generation, and comprehensive analytics further sport the platform’s capabilities. The signature request feature ensured data integrity and accountability, simplifying complex regulatory processes.